Even as India’s economy sees feeble signs of recovery, the mobility sector has fewer takers. From 115 million monthly rides across cabs, autos, and bikes to 35 million, the drop is quite sharp. We still access public transport to get us to our destination, touting it as a necessary evil, but sharing rides may be an aspect of our pre-pandemic existence that we can’t quite imagine with our current concerns regarding hygiene. Here are our thoughts on this very interesting intersection.

While writing this article for ISB Management ReThink, we told ourselves we would consciously reduce the usage of the synonyms of COVID-19 and look ahead for solutions, rather than behind, for the problem. Several vaccines notwithstanding, we are still in the midst of a global pandemic, the effects of which will be felt by individuals and companies for the foreseeable future. In the meantime, we study the forces that seek to jumpstart the country’s masked and socially distanced economy.

If this talk of the “new normal” tires you, spare a thought for the ride-sharing sector, and the countless drivers who occupy the global gig economy. As of January 2020, the ride-sharing sector, which included services for booking cabs, autos, and bikes online, recorded 115 million monthly rides[1]. However, this number came down to 35 million[2] by September 2020.

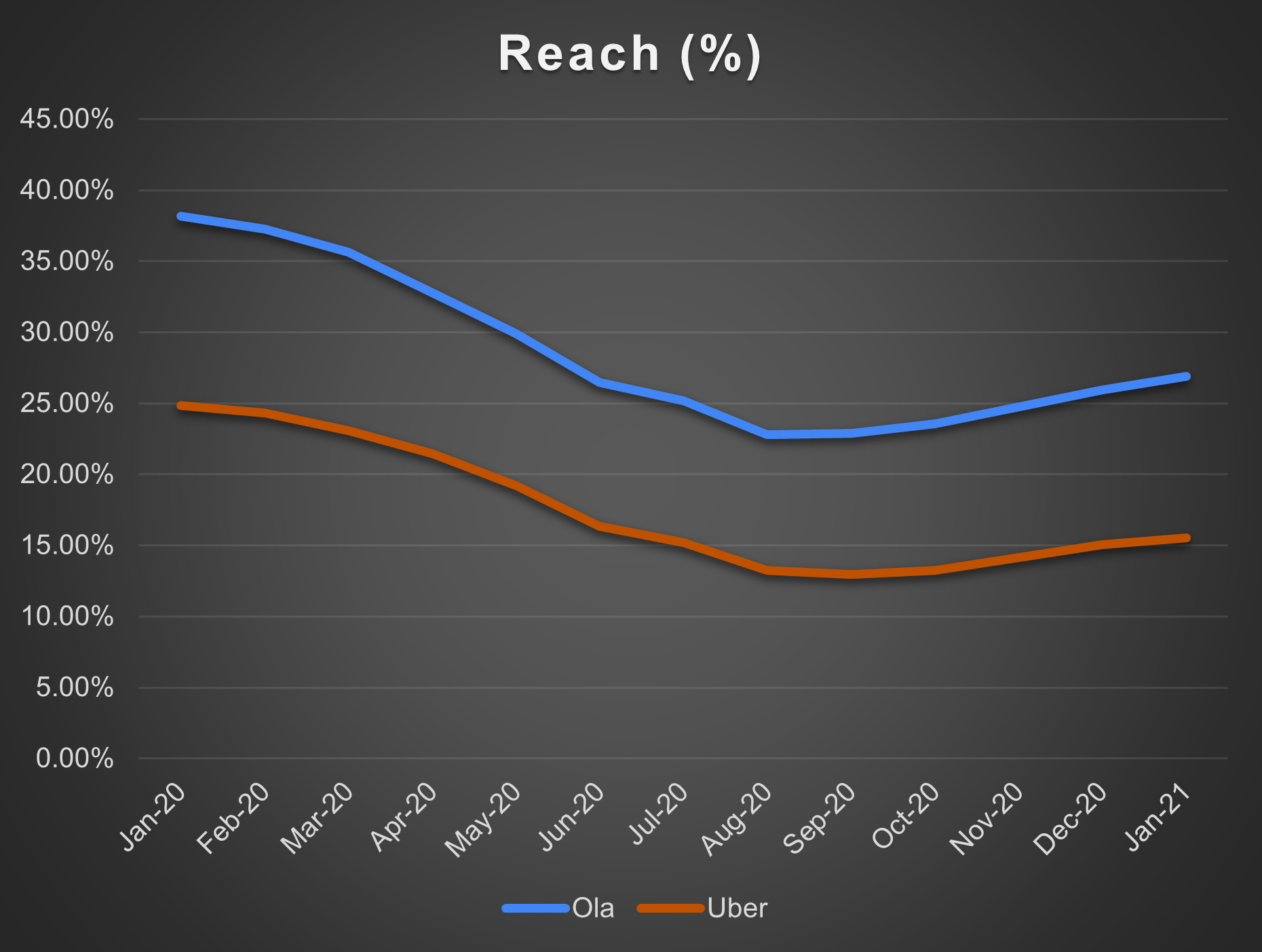

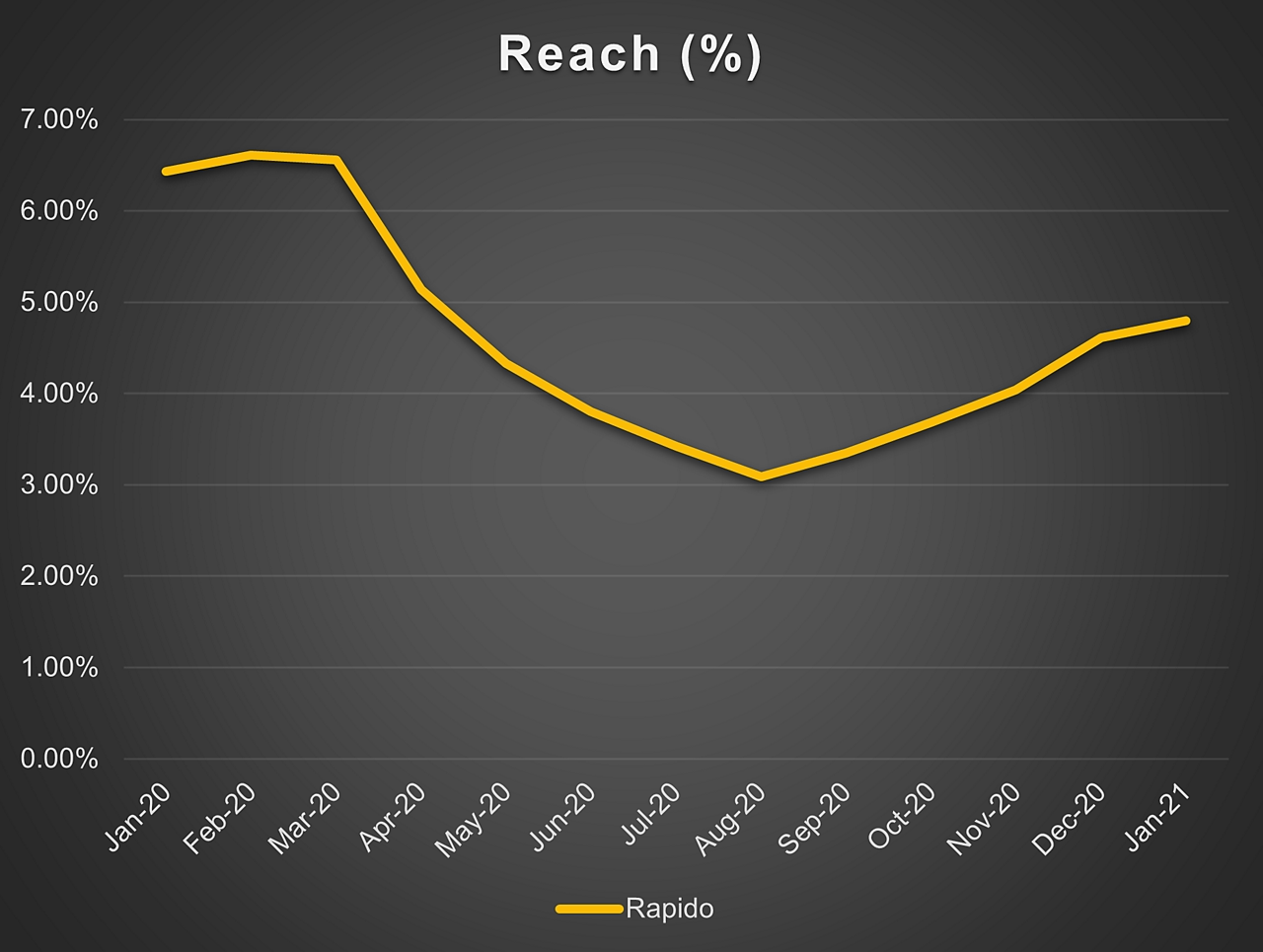

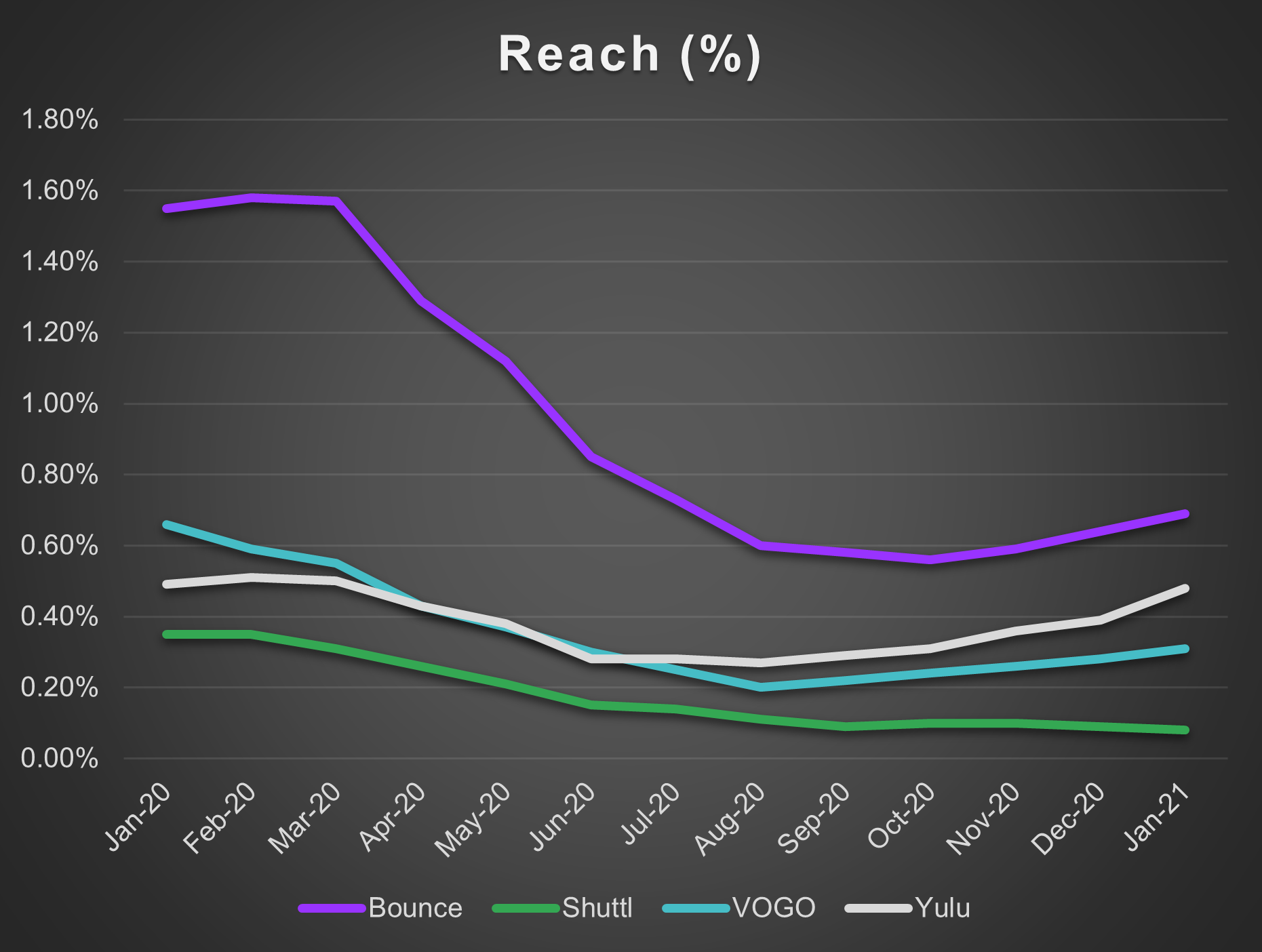

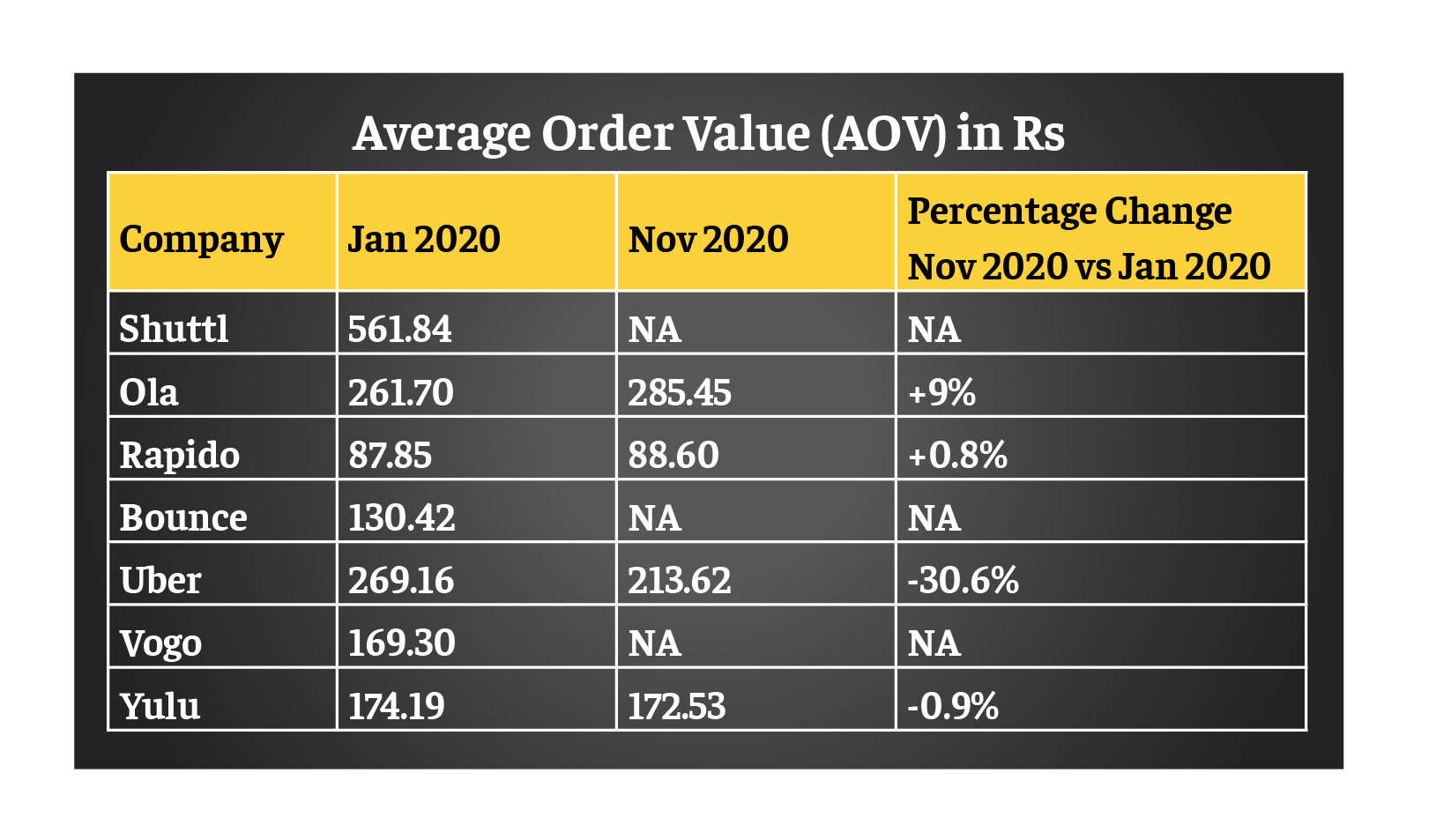

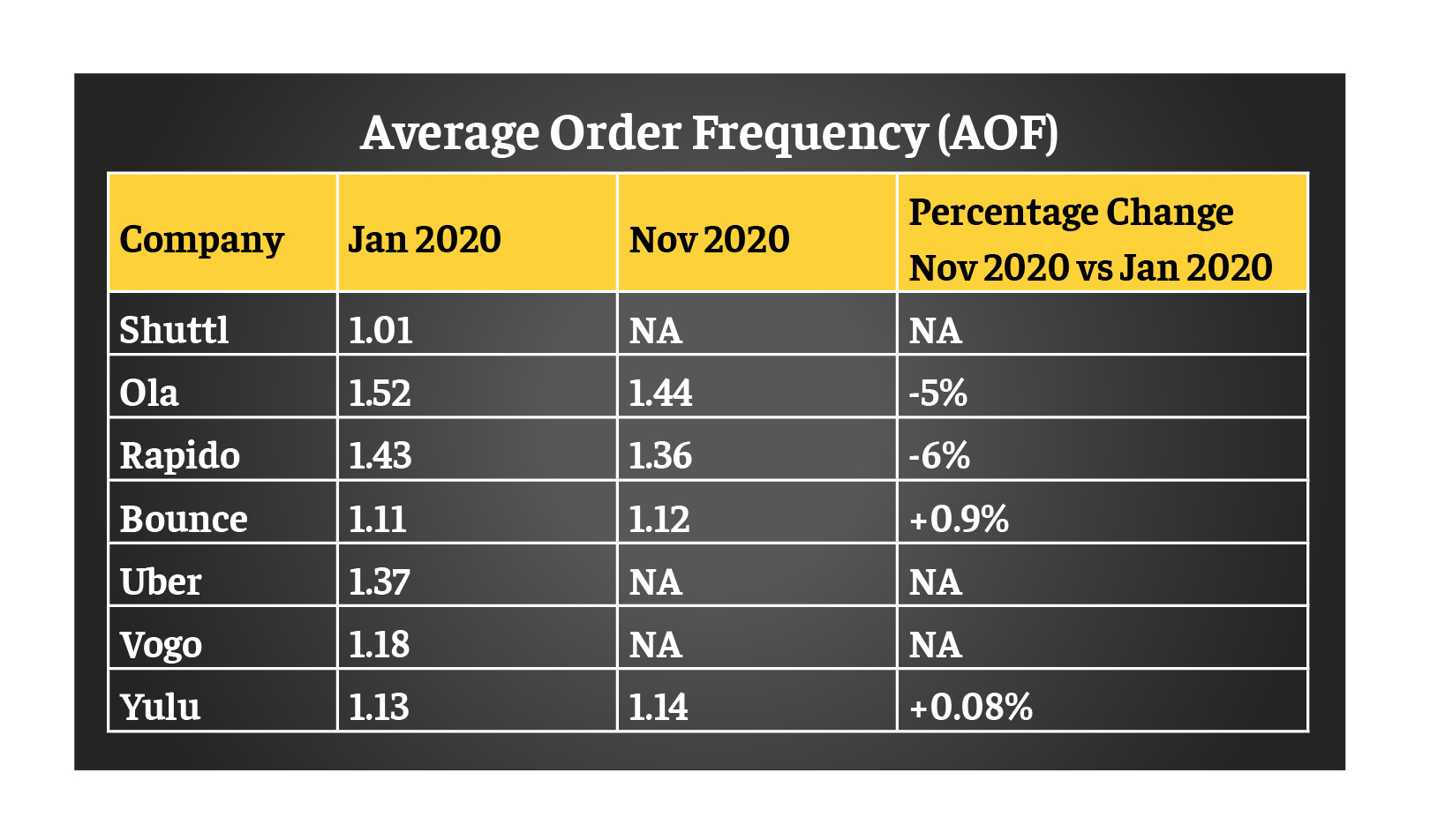

Lockdowns and travel embargos affected the reach of mobility partners with the overall decline being the worst for Shuttl, Bounce, and Vogo. Rapido and Yulu saw dips as well, but to a lesser extent. Among the larger players, Ola and Uber also saw sharp drops. With nowhere to go, perhaps users were reclaiming precious memory space on their smartphones by replacing mobility apps with those offering OTT platforms, virtual games, and connections.

While Houseparty and Hangouts had their users, Zoom emerged as the preferred choice for professional meetings and social gatherings— including both weddings and funerals. Zoom’s CEO Eric Yuan reported how the platform’s reach of about 10 million daily participants in 2019 rose to 200 million in March 2020 and 300 million in April 20203.

With successive unlocks, several sectors opened up their offices and welcomed back employees. It is these that showed promise to the mobility sector. But arriving at the pre-COVID-19 levels of utilisation may be ambitious, especially since remote and hybrid models of work continue. Further, the ride-sharing and pooling options are out of question until the major chunk of the population is vaccinated. Because while sharing is caring, ride-sharing is definitely a risk that neither companies nor users want to take in an ongoing pandemic.

Being one of the worst-affected, how is this sector measuring its resurrection?

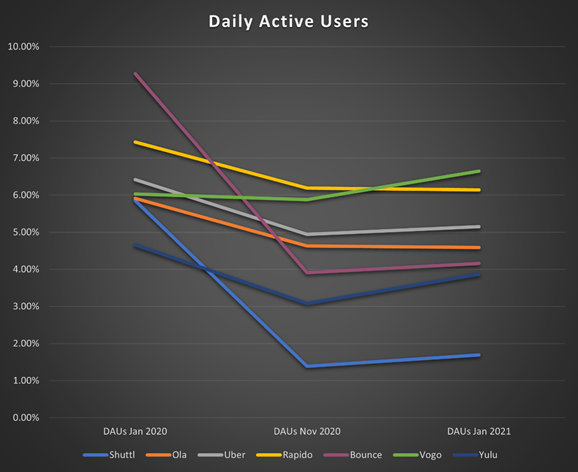

One way is by monitoring the Daily Active Users (DAUs). Of the users who have an app downloaded, the percentage of people who access the app on a given day, gives us the DAUs. See table below.

Restoring the Fleet-ing Ambition

One of the key factors in these trends is the type of inventory of these platforms, and how flexibly they lend themselves to different use cases in an environment where people aren’t necessarily using cabs or travelling to work as frequently.

- Uber/Ola primarily have cars, often with large CNG tanks in the trunk, an inventory that doesn’t necessarily lend itself to a logistics use case. So, the most logical use would be to ferry humans. Users are also uncomfortable with using vehicles where others have previously sat. The tech platforms of these companies have enabled them to explore food delivery or even financing options, a la Ola, but how they reimagine hygienic ride-sharing in a post-pandemic world will be interesting.

- Then there’s Shuttl. Their fleet primarily consists of large and small buses. So, it’s quite difficult to use this inventory for anything but transporting people.

- A fleet made up of two-wheelers, on the other hand, is very flexible. Rapido has a distinct advantage here. They can use their network to transport people, or attach their riders to a logistics network and start delivering groceries and e-commerce goods. These services made last-mile delivery of essentials convenient and accessible during much of 2020.

- Even self-drive two-wheeler rentals such as Yulu, Vogo, and Bounce can attach themselves to a logistics network. There are ample examples of how gig economy workers (riders) who don’t own two-wheelers, rent a bike for the day to earn extra money by making deliveries[4]. These platforms have the added advantage that they feel safer to use in a COVID-19 world, as they’re easy to sanitise and are open air.

With each day of low demand, mobility platforms see an exodus of driver partners and hesitation among customers—a vicious cycle. It is another matter that the economy is beginning to revive with “necessary precautions”; as a result, demand will return and so will customers and driver partners. What may change is the competitive advantage these well-established platforms enjoyed—like the bigger players having more customers or drivers. With users as well as drivers moving out of the ride-sharing economy, new players might get a more level playing field with the incumbents.

Despite being one of the worst-affected sectors, these tech-enabled platforms provided users with incomparable ease of access and last-mile delivery. The pandemic may just be the ‘orange’ light, pushing the sector to reimagine its workings. But it’s also possible that users will prefer to travel in their own (read: safer) vehicles—reviving the automobile sector, which was on a downward trend for the last two or so years. Market dynamics put us at a unique crossroads, and where we go from here matters less than the means we take to get there.